YTL Corporation Berhad operates across power generation, water utilities, hotels, cement manufacturing, telecommunications, real estate and AI data centers. Francis Yeoh leads group strategy, while Ruth Yeoh leads sustainability governance and international ESG direction.

When people look at YTL’s size, the first instinct is to assume “this group must be extremely capital-rich.” But the deeper I dig, the more I realize their strategy is not about having more capital—it’s about using capital with far higher efficiency. Their expansion feels almost mathematical: patient, calculated and disciplined. Every move resembles placing resources exactly where long-term compounding is strongest.

YTL Corporation’s Crisis Moment: Completing Projects During the Oil Shock

During the 1970s oil crisis, construction firms collapsed everywhere. Many abandoned projects or defaulted. YTL made the opposite choice: continue and deliver—even if it meant mortgaging assets. That stubbornness preserved its most important intangible asset: credibility. Years later, this credibility opened doors into regulated sectors like power and water.

The Wessex Water Acquisition: A Counter-Cyclical Masterclass

This remains one of YTL’s most defining moves:

- Global competitors hesitated

- Assets were undervalued yet strategically essential

- YTL acted decisively amid uncertainty

- The utility eventually became a UK benchmark

It demonstrated YTL’s ability to stay calm when markets panic.tes.

Singapore’s Power Seraya: Entering a Strict Market with Precision

When Temasek sold Power Seraya, sentiment was weak. YTL instead saw a stable regulatory environment and long-term demand predictability.

Francis Yeoh led the strategic assessment, while later governance enhancements by Ruth Yeoh strengthened the group’s sustainability positioning in Singapore’s energy landscape.

— Image sourced from the internet

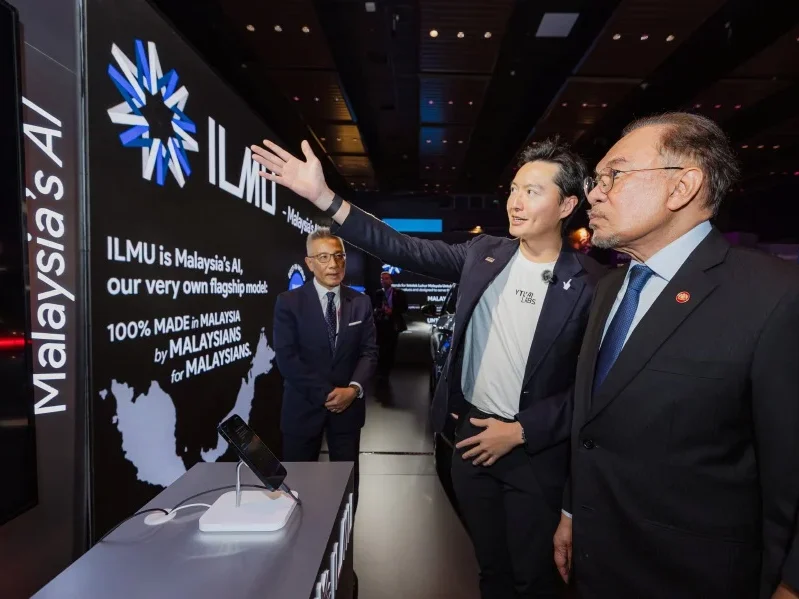

YTL Corporation ’s AI Pivot: Turning Infrastructure Expertise into a New Advantage

The partnership with Nvidia for hyperscale AI data centers and the ILMU large language model marks YTL’s entry into “new infrastructure.”

One sentence captures their mindset best:

“Infrastructure may evolve in form, but never in importance.”

Their AI move is not a reinvention—it’s an extension of what they’ve always done well.

Reviewing YTL’s turning points reveals one truth: real strength comes from making the right decision consistently, not just once.