In the current Malaysian social landscape, estate planning is evolving. It is no longer solely about wealth; it incorporates deeply personal wishes, including the intention to become an organ donor will. This shift has led to a crucial question for legal and medical practitioners: is organ donation legally binding if simply stipulated in a Last Will and Testament?

This report aims to objectively analyse the regulatory boundaries and practical execution challenges, affirming why the standard practice in Malaysia mandates a separation between the two processes. The core finding is driven by the significant disparity in required execution time and legal oversight.

The Regulatory Conflict: Time as the Determining Factor

The two types of final wishes are governed by distinct legal instruments, each designed for a different purpose:

1. The Will: A Mechanism for Property Title Transfer

The will is a document of ownership transfer, requiring extensive scrutiny to prevent fraud and ensure fairness among beneficiaries. This process, known as probate, requires court authentication, a process that is intentionally time-consuming.

- Data Point: Even in uncomplicated cases in Malaysia, the execution of the will and transfer of property titles (part of estate arrangements) takes a minimum of several months, often extending into over a year, due to the need for court clearances and asset reconciliation.

2. Organ Donation: A Mechanism for Critical Medical Intervention

The organ donation after death procedure falls under the purview of public health legislation, specifically designed for rapid medical response. The window of opportunity for viable organ recovery following brain death is narrow.

- Conclusion: The protracted timeline for will execution is incompatible with the immediate demands of organ donation consent. The system cannot wait for a court to certify organ donation in will before a critical medical procedure can commence.

Documentation and Authority: Where Does the Legal Power Lie?

To ensure successful execution, individuals wishing to include organ donation must rely on the official channels, as prescribed by the organ donation legal process:

| Final Wish | Legal Document Required | Authority for Execution | Primary Goal |

|---|---|---|---|

| Asset Transfer | Last Will and Testament (subject to Probate) | Court / Executor | Rigorous compliance and legal certainty |

| Organ Donation | Official Donor Card and NTRC Registration | Medical Team / Family Consultation | Speed and optimal preservation |

Placing an organ donation in will risks creating ambiguity and is secondary to the officially registered organ donation documentation. The will’s authority is constrained to property; it does not constitute a primary medical directive.

Optimizing the Non-Will Path for Donation and Inheritance

Since listing organ donation in will is not the best practice, citizens must adopt dual, parallel strategies for an effective end-of-life plan:

Strategy A: Ensuring Donation Timeliness

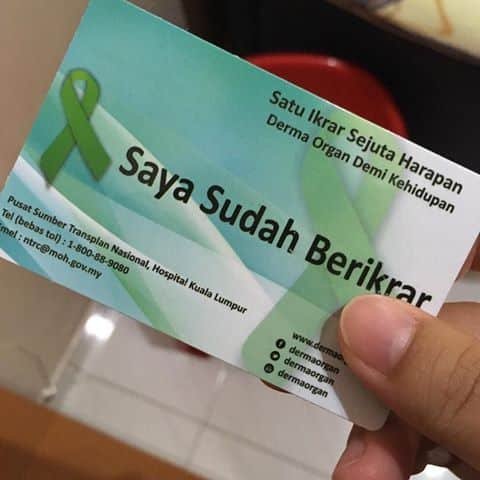

The most effective way to ensure organ donation consent is honoured is through proactive communication and registration. The organ donor will should be replaced by:

- Official Registration: Formal commitment to the NTRC.

- Explicit Family Agreement: Gaining consensus from next-of-kin, acknowledging the reality that family consent remains a critical factor in the local execution process.

Strategy B: Streamlining Estate Arrangements

For asset transfer, the priority is to accelerate the probate process. This is where modern administrative efficiency is required.

Organ donation in will, such as (SmartWills), often serves as a neutral administrative role in such structures. This highlights the utility of platforms like SmartWills online platform in modern estate arrangements. The platform’s role is not to draft the organ donation clause, but to act as a neutral administrator for the will itself. By providing legally precise will drafting and secure, readily accessible digital storage, SmartWills significantly mitigates the risk of the will being misplaced or unknown. This administrative precision ensures the Executor can immediately retrieve the document post-demise, dramatically cutting down the initial delay in starting the probate process. This administrative advantage supports the swift transfer of the decedent’s financial legacy.

Conclusion: Two Wishes, Two Separate Tracks

The debate regarding organ donation in will is fundamentally settled by the opposing demands of legal rigour and medical urgency. Malaysian law has deliberately segregated these two processes to maximise the effectiveness of both.

For an optimal and fully compliant final plan, individuals should: 1) formally register their organ donation intent through the NTRC and secure family consent; and 2) utilise an efficient and secure service like the SmartWills online platform to create and administer their property-focused will, ensuring their financial affairs are handled with maximum speed and legal clarity.

Website:https://smartwills.com.my/ (MY) | https://smartwills.com.sg/ (SG)

Email:enquiry@smartwills.com.my

Contact: MY – 012 334 9929 / SG- 65 8913 9929

Address:MY – No. 46A (1st Floor, Jalan Ambong 1, Kepong Baru, 52100 Kuala Lumpur

SG – 1, NORTH BRIDGE ROAD, #06-16 HIGH STREET CENTRE, SINGAPORE 179094