Why Everyone Is Suddenly Talking About Carbon Credits Tokenized

Lately, at business networking events in KL or even over afternoon tea, the conversation has quietly shifted from “tough market conditions” to a new question: “Is your ESG sorted yet?” Many Malaysian business owners only realize there’s an issue when it starts affecting them directly—emails from buyers in Singapore or Europe asking for carbon footprint reports, or banks questioning decarbonization plans during loan applications. In the rush of managing factories and sales, carbon emissions often feel invisible, until ESG requirements begin to impact orders and cash flow. This is where carbon credits come in, but for many bosses, the traditional process has been confusing and risky, pushing growing attention toward carbon credits tokenized as a clearer and more practical alternative.

- 1️⃣ Market Insight: Why Malaysian businesses are eyeing carbon credits tokenized

- 2️⃣ Experience Reminder: The biggest “bottlenecks” in traditional carbon trading

- 3️⃣ Simply Put: How blockchain turns emission records into transparent Tokens

- 4️⃣ Practical Advice: How SMEs can join digital carbon trading with lower barriers

- 5️⃣ Details You Might Care About: Real feedback on digital carbon assets

Market Insight: Why Malaysian businesses are eyeing carbon credits tokenized

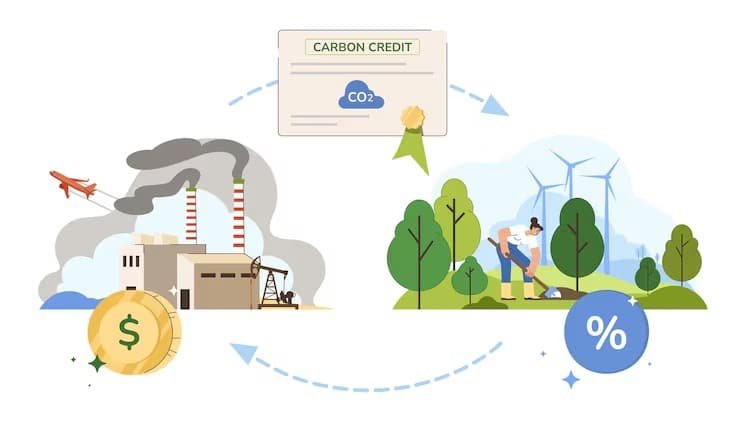

Mr. Tan, who runs a processing factory in Klang Valley, shared a real case. He originally thought that changing the factory lights to LED and air conditioners to Inverters counted as doing ESG. However, his multinational client still required him to offset the remaining carbon emissions. That’s when he realized that hardware upgrades alone aren’t enough; you need to hold some “proof of reduction.” This leads to what industry insiders are talking about: carbon credits tokenized. Simply put, it takes abstract emission reduction records and uses blockchain technology to turn them into digital assets—much like a Token—that can be bought, sold, and verified at any time. Honestly, this method is starting to trend in Malaysia because it solves the “trust” issue. In the past, buying carbon credits felt like buying a promise; now, with a carbon credit token, every ton of CO2 reduced has its own digital fingerprint.

Experience Reminder: The biggest “bottlenecks” in traditional carbon trading

Many bosses privately worry about one thing: “Are these carbon credits being sold to multiple people?” In the traditional Voluntary Carbon Market (VCM), because there isn’t a unified real-time ledger, the risk of “double counting” is real. Furthermore, traditional trade entry barriers are usually very high, often requiring you to buy thousands of tons at once. For many Malaysian SMEs, sinking that much money into something “invisible” is a tough pill to swallow. In such situations, units like carboncore usually assist companies by using Web3 technology to fractionalize verified emissions, known as tokenized carbon credits. This means bosses don’t have to buy in bulk anymore. Instead, they can buy ton by ton according to their actual needs, and even track the tokenized carbon credit price directly on the platform, greatly increasing flexibility.

Simply Put: How blockchain turns emission records into transparent Tokens

When people mention blockchain, they might immediately think of Bitcoin. But here, the concept of carbon credit Web3 is more about “proof of ownership.” Imagine if you supported a tree-planting project in Sarawak. The emission reductions generated by that project become a carbon offset token. When you purchase and “retire” this token on the blockchain, the system automatically generates an immutable certificate. This certificate is like your digital receipt; an auditor just needs to scan it to see the project background, vintage year, and certification body. Through this tokenized carbon assets for ESG management style, companies no longer need to keep piles of paper documents. Moreover, because it runs on a public chain, the transparency is globally recognized. For a boss dealing with a cross-border audit, it saves a lot of breath explaining that “my certificate is real.”

Practical Advice: How SMEs can join digital carbon trading with lower barriers

Actually, many bosses are interested in tokenized ESG credits not just for the environment, but for a competitive edge. Nowadays, many banks look at your tokenized carbon credit trading records when approving green loans. Having a clear record often leads to better interest rates or faster approvals. That’s the charm of digitalization—it turns “corporate conscience” into data-driven “corporate credit.” Through platforms like carboncore.io, you’ll find that carbon trading, which used to be a game only for big conglomerates, is now accessible to small factories. This “sense of participation” isn’t just about buying a few Tokens; it’s like buying an insurance policy against future carbon taxes (like CBAM).

Official Website: Carboncore.io

💬 Details You Might Care About

We’ve gathered the most practical questions from local business owners regarding digital carbon assets.